Apple Pay has become an essential part of the Apple ecosystem, allowing users to pay for their purchases conveniently using their iPhone or Apple Watch. While initially introduced as a payment method for purchases, Apple has been working hard to expand its scope over the past few years. The company introduced Apple Card back in 2019 and more recently, it unveiled the ‘Tap to Pay’ service, allowing users to accept contactless payments using just their iPhones.

And now, the company has introduced a new payment feature called Apple Pay Later. Apple Pay Later is a new payment feature that allows users to split their Apple Pay purchases into four interest-free payments over six weeks. In this article, we will take a look at Apple Pay Later in detail and check out its features and benefits.

What is Apple Pay Later?

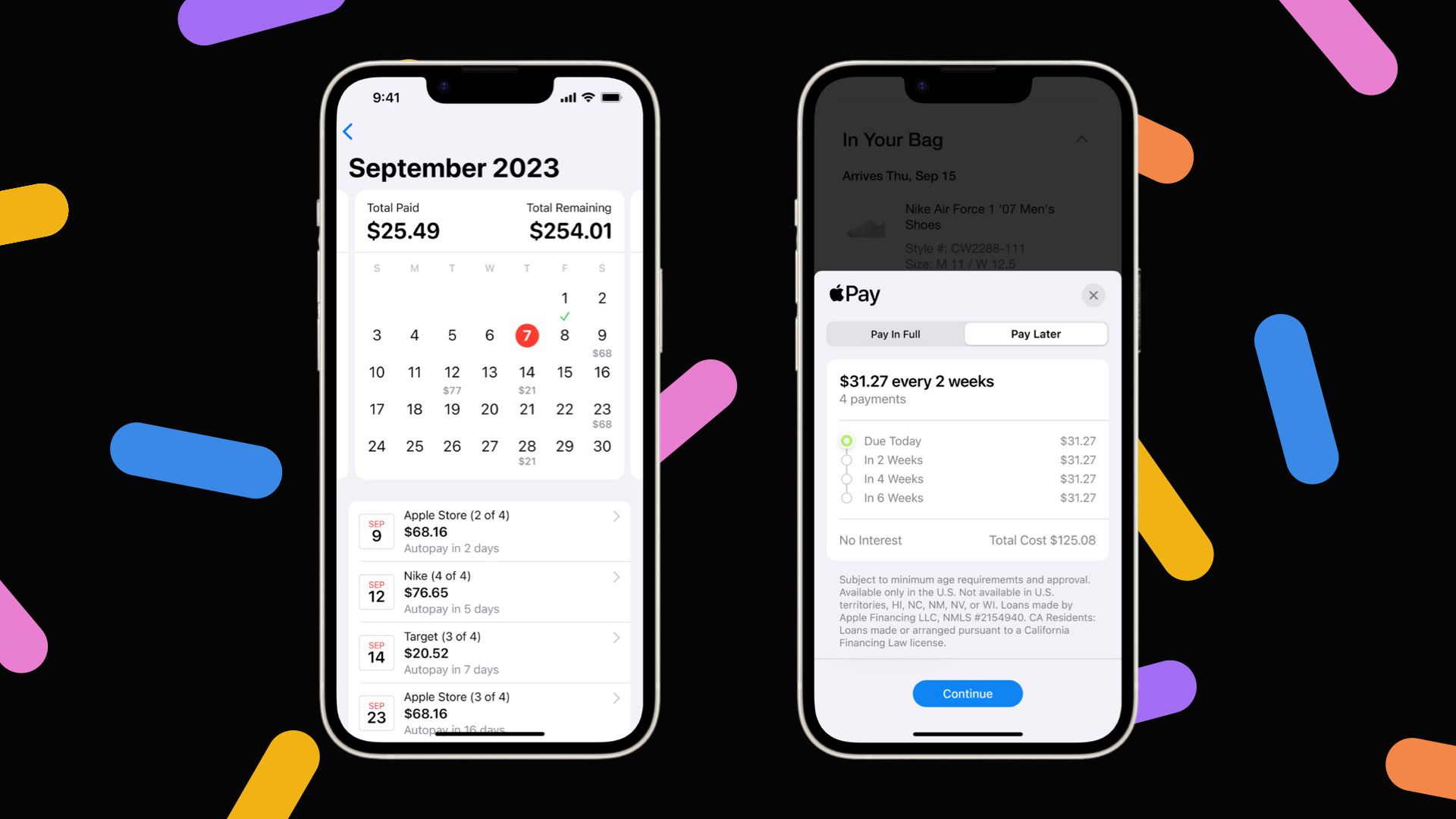

Apple Pay Later allows users to split their purchases into four equal interest-free payments spread over six weeks. It works everywhere Apple Pay is accepted, and the company says that merchants need to do nothing to implement Apple Pay Later for their customers. Think of it as an interest-free ‘buy now, pay later’ scheme that can be used everywhere Apple Pay is accepted.

Apple Pay Later: How it works

The feature is directly integrated into the Apple Wallet app. Users can apply for a loan amount ranging from $50 to $1,000. Apple says when a user applies for an Apple Pay Later loan within the Wallet app, it will not impact their credit score.

When a user applies for the loan, a soft credit check is conducted to ensure the user is in good financial standing. If approved, the user can use Apple Pay Later to make purchases using their iPhone. And once Apple Pay Later is set up, users can also apply for a loan directly in the checkout flow when making a purchase.

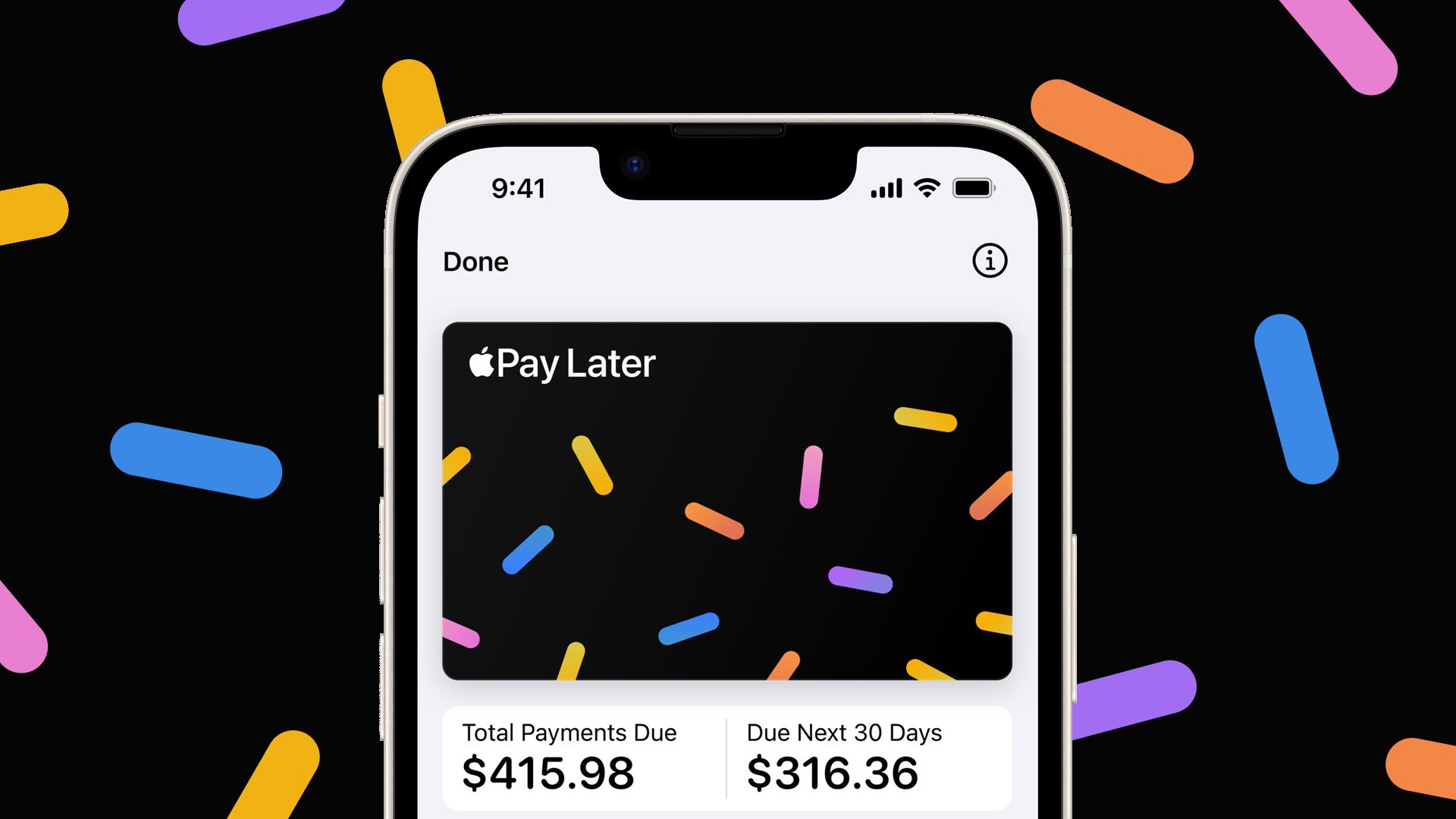

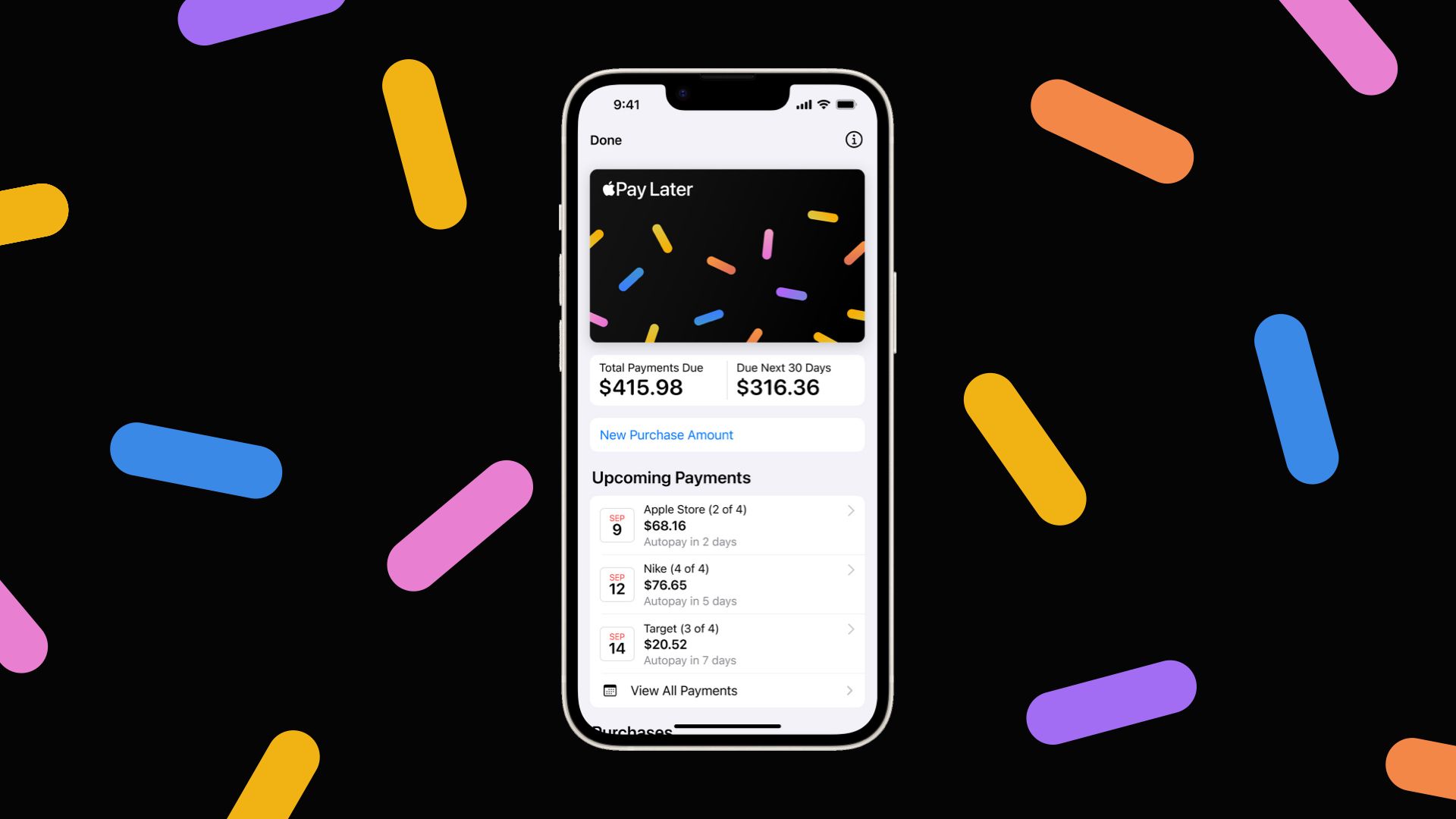

Users can view and manage their loans from the Apple Wallet app. The Wallet app will show you the total amount due for all the existing loans as well as the total amount due in the next 30 days. There is even a calendar view that helps the users track and plan their payments. Apple says the user will receive a notification via Wallet app and email before the payment is due.

To repay the loan, users will be required to link their debit card. Credit cards are not supported. Apple Pay Later is enabled through the Mastercard Installments program in partnership with Goldman Sachs.

Apple Pay Later: Features and benefits

Interest-free payments

One of the significant benefits of Apple Pay Later is that it offers interest-free payments for up to six weeks, unlike some other credit cards and ‘Buy now, pay later’ schemes. Users can split their purchases into four payments over six weeks with zero interest and no fees. However, the exact details of what happens if a user exceeds the six-week payment period and the interest rate that applies after this period are currently unclear.

No credit impact

Apple says when a user applies for a Pay Later loan, it does not impact the credit score of the user. A soft credit check is done, which will not impact users’ credit score. However, Apple in the footnotes of its press release does state that a user’s Apple Pay Later loan and payment history ‘may be reported to credit bureaus,’ which may impact their credit score.

Easy to manage

Since Apple Pay Later is built right into the Wallet app, it makes managing loan repayments very easy. User will be provided with a clear ‘total amount due’ for their existing loans and the amount due in the next 30 days. Apple will also send a notification and email well before the payment is due.

Source: Unsplash

Apple Pay Later: Availability

Apple Pay Later is currently available only in the United States in a limited capacity. Users can take benefit of this feature on all online and in-app purchases made on their iPhones using Apple Pay. However, access to this feature is currently limited to randomly selected users who have been invited to try out a prerelease version of the feature.

While the feature is a part of the iOS 16.4 software update, it is not yet available to all eligible users. Apple has stated that it “plans to offer” Apple Pay Later to all eligible users in the coming months. To check if you have access to the feature, head to the Wallet app on your iPhone right now.

Check out these amazing Apple iPhones!

-

iPhone 14 Pro Max

iPhone 14 Pro is the latest large-screen premium smartphone from the brand. It features a new pill-shaped ‘Dynamic Island’ notch, 48MP primary camera sensors, an A16 Bionic chipset, and much more.

-

iPhone 14 Pro

iPhone 14 Pro is the latest premium smartphone from the brand. It features a new pill-shaped ‘Dynamic Island’ notch, 48MP primary camera sensors, an A16 Bionic chipset, and much more.

-

Apple iPhone 13

iPhone 13 is still going strong. Powered by the A15 Bionic processor, this smartphone holds up well even in 2023. If you’re looking for an experience that remains fast and fluid over years to come and not lacking on any hardware front, this is the device to get.