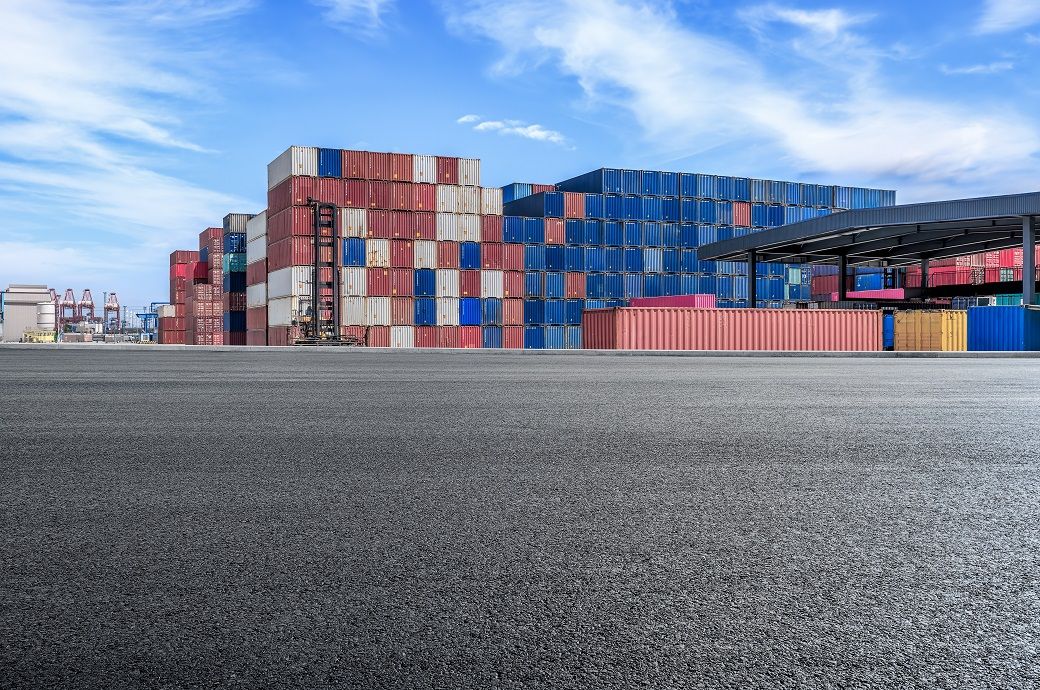

If the tariffs persist beyond two years without mitigation or other growth drivers, it will squeeze Asian port operators’ revenues and financial leverage.

India’s Adani Ports and Special Economic Zone Ltd can withstand up to 22 per cent of overall volume hit in fiscal 2025-26 (FY26). It mainly serves domestic needs and the rating agency believes it will be more resilient due to the origin and destination (O&D) nature of the volume.

US tariffs mean Asian ports, especially those in China, may face their biggest abrupt decline in throughput in their operating history, according to S&P Global Ratings, whose stress tests show rated Asian port operators have headroom to absorb demand risks this year.

India’s Adani Ports and Special Economic Zone Ltd can withstand up to 22 per cent of overall volume hit in FY26.

Adani Ports’ total capital expenditure (capex) over FY26 and FY27 will likely remain high at ₹120-130 billion a year due to its growth aspirations. This capex includes discretionary spending, acquisitions, and investments in equity affiliates. However, most of its discretionary spending of ₹50-55 billion a year over the same period is modular. As such, Adani Ports has the flexibility to lower capex, if required, S&P Global Ratings noted.

Asian ports, particularly those in China, face unprecedented throughput challenges. The latest round of US tariffs has emerged as a significant hindrance alongside volume volatility, it noted.

If the current levels of tariffs remain for goods from China, it will cause a prolonged plunge in volume on China-US routes. This would affect port operations and force a rerouting of goods through other countries, such as those in Southeast Asia, assuming no other tariffs are imposed.

This may temporarily boost volumes of intra-Asia routes as manufacturers that have capacity in Southeast Asia are rushing production to sell to the United States during the 90-day pause in implementation. But it won’t compensate for losses on China-US routes.

Despite these obstacles, analysis by S&P Global Ratings shows rated Asian port operators maintain sufficient financial resilience to handle throughput declines in 2025. Prolonged tariffs could lead to cuts in capital expenditure or lower dividend distributions.

The magnitude of the tariff impact and how the sector adjusts will take time to play out. The rating agency believes shipments will be severely held back between China and the United States as long as the high tariffs remain effective. Of China’s total exports, about 15 per cent go to the United States. For some ports in China, the exposure to the United States is much larger.

China’s Southeast Asian trading partners also face material impact. Manufacturers using a ‘China-plus-one’ or ‘China-plus-x’ supply-chain strategy can expedite shipments from alternative countries to the United States.

However, S&P Global Ratings believes China’s manufacturing capacity will remain significant and irreplaceable for the next 12-18 months at least. During this time, the impact on individual port operator will vary according to their throughput mix. This will also depend on the outcome of the 90-day pause and other new tariffs placed or exempted.

Over the next five to ten years, a shift in the supply chain will be the key driver of growth in port throughput. If China remains exposed to much higher tariffs than other countries, the supply chain shift will likely accelerate.

Eventually, if manufacturers rebalance their supply chain to materially shift away from China, it could structurally erode a portion of port throughput.

China’s Shanghai International Port (Group) Co Ltd and Hutchison Port Holdings Trust can withstand an overall volume hit in 2025 of up to 27 per cent. HPHT, which has the highest exposure to China-US routes among the rated issuers, may face the largest downside risks under the current tariff policy.

China Merchants Port Holdings Co Ltd has smaller headroom of 14 per cent compared with other rated port operators.

China’s intermediate trade has been a key driver of growth of Asia ports, at least until now. This may slow down if there are high tariffs on most Asian countries, it added.

Fibre2Fashion News Desk (DS)