From Taylor Swift T-shirts to Fleetwood Mac Rumours vinyl LPs, the global music merchandise business will grow to a retail value of $16.3 billion by 2030, according to a new report by MIDiA Research.

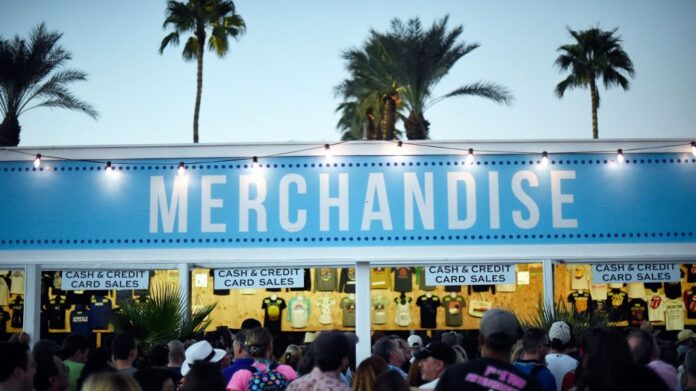

Merch become a priority for many artists in 2020 when the COVID-19 pandemic shut down the concert business. And as touring resumed and fans opened their wallets, the global merch business rose to $13.4 billion in 2023. But merch sales are expected to cool considerably, as MIDiA forecasts merch sales will grow at a compound annual growth rate (CAGR) of just 2.8% through the end of the decade. There’s still plenty of opportunity, though — if artists and merch companies don’t treat merch like a cash grab.

“As the market has become more sophisticated, fan expectations for quality have risen,” MIDiA’s Tatiana Cirisano said in a statement. “But record labels focusing on monetising fandom risk ‘overharvesting’ — exploiting this resource to the point of diminishing returns.”

Music companies, Cirisano added, “must nurture deep, long-lasting fandom to sustain this growth.”

Physical music, which MIDiA considers to be merch because many consumers treat vinyl LPs and CDs as collectible items, is forecasted to peak in 2025 and decrease through 2030. Physical merchandise such as artist-branded apparel and digital merchandise such as virtual goods and NFTs are expected to make up for physical music’s decline and lift total merch revenues.

Merch isn’t the most financially appealing part of the music business. That would be digital music, which enjoys both higher margins and higher growth rates. In the first half of 2024, Universal Music Group’s recorded music business had earnings before interest, taxes, depreciation and amortization (EBITDA) margin of 25.4%, nearly five times its merch division’s 5.3% EBITDA margin. And while MIDiA expects merch to grow at a 2.8% CAGR through 2030, Goldman Sachs forecasts the global music streaming market will grow at a 9.9% CAGR over that time frame.

But merch has always been an important part of the music business because of music fans’ unending desire for T-shirts and keepsakes of their favorite artists. Consolidation in the merch business began about six years ago as major labels and some indies invested in merchandising companies to diversify their revenues and expand the services they offer to artist clients.

Warner Music Group, for example, acquired German merch specialist EMP in 2018. Universal Music Group acquired boutique merch company Epic Rights in 2019. Sony Music Entertainment made a strategic investment in merchandise company Ceremony of Roses in 2022, and its Thread Shop merch agency purchased the merch division of The Araca Group in 2019. Also in 2019, Indie company EMPIRE took a majority stake in merch/ecommerce company Top Drawer Merch / Electric Family.