A host of banking issues is complicating matters for the Fed, but are there silver linings for commercial real estate?

-

Banking issues complicate matters for the Fed

-

Rate hike expectations downshifting

-

Inflation slowly cooling

-

Retail sales better than headlines suggest

-

CRE looking for silver linings

The phrase “move fast and break things” often gets associated with technology companies, and rightfully so. But in this instance, it seems like the Fed has broken something, or at least contributed to something breaking. By now, much ink has been spilled discussing recent bank failures, a lot of it by people with no banking expertise. We do not wish to contribute to that din. But the situation certainly warrants consideration in the larger economic context, especially with the Fed meeting this week.

What’s the Fed to do?

Just last week we wondered what the Fed has to show for its aggressive hiking. In short, not as much as it would like. But now it seems that it has gotten more than it bargained for. The Fed’s aggressive hiking aimed to bring down inflation, with price stability the first part of its dual mandate. But the Fed likely waited too long to begin raising rates and then raced to catch up. In the process, the Fed likely knew that it was going to cause some damage to the economy to cool inflation. Namely, the Fed would probably have to sacrifice millions of jobs on the altar of price stability, risking its second mandate, full employment.

The Fed’s third mandate, financial stability, forced itself into consideration within the last week or so. The Fed’s aggressive hiking strategy contributed to recent banking issues. That does not absolve individual banks from responsibility, but clearly the rapid increase in rates played a role. Will that cause the Fed to adjust its course this week? While impossible to say for certain, the situation certainly warrants caution. We often hear that the Fed raises rates until it breaks something. Yet, it seems improbable that the Fed would cut rates this week or even pause rate hikes. Recent disruptions might soften their stance relative to expectations of a few weeks ago. Clearly, the futures market believes that the Fed will turn less hawkish, if not dovish, in the face of increasing financial instability. A hike of 25 basis points (bps) seems the most likely at this point.

“…it seems improbable that the Fed would cut rates this week or even pause rate hikes.”

What does it mean for the economy? Overall, the situation certainly amounts to a net negative. Will other banks run into trouble? While the government’s lending program should prevent the economic situation from getting much worse that does not mean it will avoid more bank runs. That largely depends on whether people behave in a calm, rational manner. What we are watching closely is the extent to which this causes lending to slow and/or how debt spreads are impacted. Tighter lending standards would present a minor drag on economic growth.

Remember data?

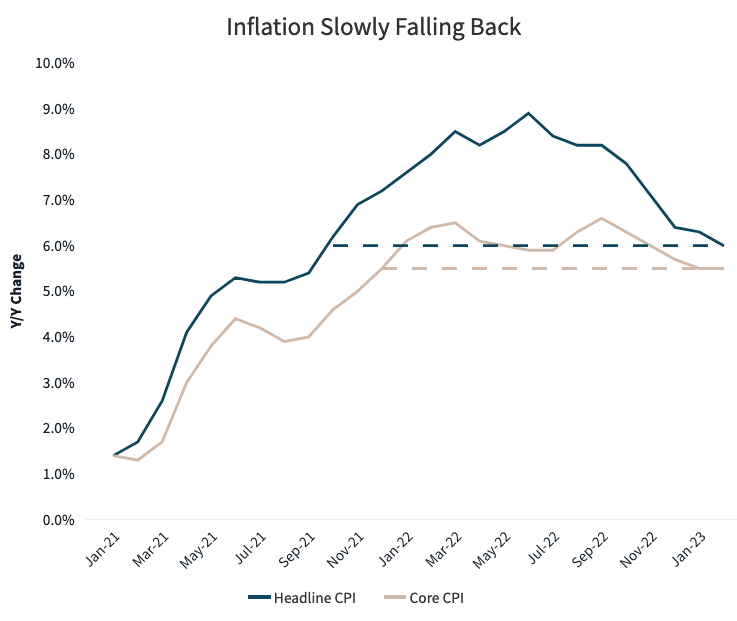

Seemingly lost during an onslaught of banking news, economic data releases showed some important developments. First, on the inflation front, data continued to show gradual cooling. Both the monthly headline and core consumer price index (CPI) for February came in roughly as expected, with the core CPI coming in just above expectations. On a year-over-year basis both indexes continued to cool gradually. The headline CPI eased to 6% year-over-year, the slowest rate since September 2021. Meanwhile, the core CPI grew at 5.5% on a year-over-year basis. The was equivalent to January’s pace, even with the rate from December 2021.

Meanwhile, the producer price index (PPI) for February came in below expectations. The headline PPI surprisingly declined slightly while the core index came in flat. The headline index declined predominantly because of a drop in food prices, notably eggs which had recently garnered headlines because of how expensive they had become. On a year-over-year basis, both headline and core slowed more than expected and continued their trend of slowly decelerating. Overall, the data shows that inflation is easing, but slowly and inconsistently.

Retail sales better than first blush

Retail sales for February looked negative at first blush. But the details appear more favorable. Overall retail sales declined during the month, as anticipated. But overall sales for both January and December got revised upward. The key control series (which excludes autos, gas, building materials and food services) increased by +0.5% month-to-month in February, versus the -0.3% consensus. January and December got revised upward. The control series feeds directly into the GDP calculation and bodes well for first quarter consumption and GDP growth. With the labor market remaining tight and consumers still sitting on excess savings, spending remains resilient even in the face of elevated inflation and high interest rates.

What it means for CRE

We want to take care not to overreact to a fluid, dynamic situation. But right now, the net effect of the last week seems mostly negative, even without additional bank runs or failures. A tightening of lending standards would slow economic growth, generally unhelpful to commercial real estate (CRE). But some potential positives exist. Interest rates have declined, which could help some interest-rate-sensitive segments like the for-sale housing market. Rate hikes could possibly slow, but increased uncertainty and concern regarding the banking system are not ideal ways to accomplish that. But if all of this were to bring about a faster end of the tightening cycle, the would be an unambiguous positive for CRE. As we have said many times, the Fed doesn’t need to stop raising rates. It just needs to let everyone know when that is coming. Maybe the Fed arrives at that point faster now, but this is a risky way to go.

“…if all of this were to bring about a faster end of the tightening cycle, the would be an unambiguous positive for CRE.”

Source JLL